Taxmann Forensic Foresight Case-Based Perspective on Forensic Accounting Standards By Durgesh Pandey Edition July 2024

₹995 Original price was: ₹995.₹745Current price is: ₹745.

This book is a practical handbook for understanding and applying the Forensic Accounting and Investigation Standards (FAIS) issued by ICAI. The book serves as detailed guidance to professionals investigating the Financial Crime Landscape. It emphasises practical examples and provides analysis and tools for immediate professional use. This book includes in-depth explanations, real-world applications, actionable tools, global comparisons, and practical advice.

Taxmann Forensic Foresight By Durgesh Pandey

Taxmann Forensic Foresight By Durgesh Pandey

Description

This book is a practical handbook for understanding and applying the Forensic Accounting and Investigation Standards (FAIS) issued by the Institute of Chartered Accountants of India (ICAI). The book serves as detailed guidance for professionals investigating the financial crime landscape. Prioritising practical examples over theoretical discourse extends the ICAI’s comprehensive resources. It is designed as a practice guide, providing insights and tools for immediate application in professional settings.

This book is helpful for forensic accounting professionals, fraud examiners, chartered accountants and ICAI members seeking to enhance their expertise, auditors and investigators seeking comprehensive knowledge, students and academics needing a blend of theory and practice, and legal professionals handling financial fraud cases. The book highlights a detailed step-by-step process of investigating financial crime. It is also beneficial for regulatory authorities and law enforcement officers overseeing financial crime investigations, as well as corporate executives and managers aiming to implement effective forensic accounting practices to detect and prevent fraud in their organisations.

The Present Publication is the Latest Edition, authored by Dr (CA) Durgesh Pandey, with the following noteworthy features:

- [In-depth Conceptual Understanding] Each FAI Standard is thoroughly explained to ensure a comprehensive understanding of fundamental concepts

- [Real-world Application] The book features a master case encompassing all 20 FAIS, presenting a cohesive narrative to demonstrate their practical application

- [70+ Caselets and 20+ Case Studies] Each standard is illustrated with several caselets and a case study, providing real-world examples and insights of application

- [15+ Actionable Tools] The book includes over 15 actionable tool templates for immediate use in professional settings

- [Global Comparisons] Comparative analysis of FAIS with international forensic accounting standards to give a broader context of the financial crime landscape

- [Visual Aids] Graphs, tables, and charts are utilised to clarify complex concepts and enhance understanding

- [Practical Advice] Includes do’s and don’ts for forensic accounting professionals to improve practical application

- [Mnemonics] Easy-to-remember mnemonics for each standard aid in retention and application

The structure of the book is as follows:

Overview and Evolution

- Overview of Forensic Accounting – Definitions, scope, and the significance of forensic accounting in the contemporary landscape

- Forensic Accounting Standards – Historical context and the development of global and Indian standards, providing a comprehensive background to FAIS

Detailed Standard Analysis

- Each chapter in this section is dedicated to an individual standard and follows a consistent template:

- Conceptual Overview – An introduction to the standard, setting the stage for deeper analysis

- Core Ideology – Explains the necessity and logic behind the standard, highlighting its role in refining forensic engagements

Practice-Oriented

- Real-world Applications – Detailed explanations of how each standard is applied in practice

- Caselets – Short, focused examples illustrating key concepts

- Case Study – An in-depth look at a specific instance of the standard’s application

- Do’s and Don’ts – Practical advice to guide professionals in the application of each standard

- Key Deliverables – Actionable templates and proformas tailored to each standard

- Chapter Summary – Mnemonics and summaries to reinforce understanding and retention

Standards covered include, but are not limited to:

- FAIS No. 110: Nature of Engagement

- FAIS No. 120: Fraud Risk

- FAIS No. 130: Laws and Regulations

- FAIS No. 140: Applying Hypotheses

- FAIS No. 210: Engagement Objectives

- FAIS No. 220: Engagement Acceptance and Appointment

- FAIS No. 230: Using the Work of an Expert

- FAIS No. 240: Engaging with Agencies

- FAIS No. 250: Communication with Stakeholders

- FAIS No. 310: Planning the Assignment

- FAIS No. 320: Evidence and Documentation

- FAIS No. 330: Conducting Work Procedures

- FAIS No. 340: Conducting Interviews

- FAIS No. 350: Review and Supervision

- FAIS No. 360: Testifying before a Competent Authority

- FAIS No. 410: Applying Data Analysis

- FAIS No. 420: Evidence Gathering in Digital Domain

- FAIS No. 430: Loans or Borrowings

- FAIS No. 510: Reporting Results

- FAIS No. 610: Quality Control

Ethical Considerations and Future Trends

- Ethical Considerations – Essential guidelines for maintaining ethical standards in forensic accounting

- Future of Forensic Accounting – Analysis of emerging trends and the evolving landscape of forensic accounting

How to Use This Book

- Part A – Overview and Evolution

- Begin with this section to gain a foundational understanding of forensic accounting and the development of standards

- Part B – Detailed Standard Analysis

- Proceed to this section for an in-depth analysis of each standard, presented in a logical and sequential order to enhance interconnected learning

- Part C – Ethical Considerations and Future Trends

- Finish with this section to explore ethical considerations and future trends, completing your comprehensive understanding

About the author

Durgesh Pandey

Dr (CA) Durgesh Pandey is a managing partner of DKMS & Associates and the first PhD in Forensic Accounting from the National Forensic Sciences University, an Institute of National Importance under the Ministry of Home Affairs, Government of India. He is a Fellow Member of the Institute of Chartered Accountants of India, a Law Graduate, holds a Diploma in Information System Audit (DISA) from ICAI and is a Certified Fraud Examiner from ACFE, Texas, USA.

Dr Pandey’s specialisation areas include:

- Forensic Accounting

- Fraud Examination

- Financial Crime Investigation

- Business Consultancy

He has extensive experience in legacy audit domains. His work includes designing systems procedures, accounting manuals, and company management information systems. He has worked as an auditor and subject expert with various government organisations and banks.

He is an accomplished researcher presenting papers across the world and has recently completed a research project on trans-border frauds sponsored and on behalf of the UK Home office

He has conducted more than 200 forensic investigations and fraud examinations, serving as a consultant to regulatory bodies such as:

- CID Crime and Railways (Gujarat State)

- Economic Offence Wing – Gujarat State

- Anti-Corruption Bureau

- Enforcement Directorate

He is recognised in 420.in’s Cyber Quotient – CQ100 list as one of India’s most influential cyber pioneers, Dr Pandey is also a core member of the Special Investigation Team set up by the Anti-Corruption Bureau, Gujarat. He has received commendation letters from the Director General of Police, Gujarat State, for exemplary work in investigation.

A sought-after speaker, Dr Pandey has presented at prestigious institutions like the National Forensic Science University, the Indian Institute of Corporate Affairs, the National Police Academy, and more. He has trained over 17,500 chartered accountants and police officers in financial crime investigations from more than 35 countries. Additionally, he has presented papers at various international conferences and forums.

| Weight | 0.5 kg |

|---|---|

| binding | Paperback |

| edition | Edition 2024 |

| hsn | 49011010 |

| language | English |

| isbn | 9789357780254 |

| publisher | Taxmann |

| bookauthor | Durgesh Pandey |

₹13,980 Original price was: ₹13,980.₹10,485Current price is: ₹10,485.

₹1,895 Original price was: ₹1,895.₹1,420Current price is: ₹1,420.

Related products

Bharat Practical Guide to Ind-AS & IFRS By Kamal Garg Edition 2024

Bharat Treatise on Right to Information Act, 2005 By Niraj Kumar Edition 2024

Taxmann Guide to Motor Vehicles Act 1988 As amended by Motor Vehicles (Amendment) Act 2019

Commercial Ind AS Practices Demystified By CA Santosh Maller Edition June 2023

Bharat Commercial Contracts [With FREE Download] By R. Kumar Edition March 2024

Bharat Micro, Small & Medium Enterprises Development Act, 2006 (Law, Policies & Incentives) By Abha Jaiswal Edition August 2023

Taxmann Benami Black Money & Money Laundering Laws Edition April 2025

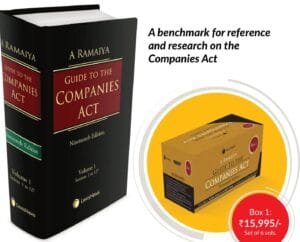

LexisNexis A Ramaiya Guide to the Companies Act (Set of 6 Volumes) By A Ramaiya Edition November 2020

₹995 Original price was: ₹995.₹745Current price is: ₹745.

![Bharat Commercial Contracts [With FREE Download] By R. Kumar Edition March 2024](https://www.makemydelivery.com/wp-content/uploads/2024/11/8185COMMERCIAL-CONTRACTS-300x460.jpg)

Reviews

There are no reviews yet.