CA Inter Cracker Papers 1 to 3 Advanced Accounts Law and Tax

CA Inter Cracker Papers 1 to 3 Advanced Accounts Law and Tax

Description

This Combo for CA Inter | Group I – Papers 1 to 3, is authored by CA. Parveen Sharma, CA. Kapileshwar Bhalla, CA. Pankaj Garg, CA. (Dr) K.M. Bansal, and Dr Sanjay Kumar Bansal. It covers the new syllabus as per the ICAI for the May/Sept. 2025 Exams. It includes the following books:

- CRACKER for Advanced Accounting (Paper 1 | Advanced Accounts)

- CRACKER for Corporate & Other Laws (Paper 2 | Law)

- CRACKER for Taxation (Paper 3 | Tax)

The key features of these books are as follows:

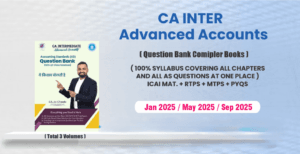

CRACKER for Advanced Accounting (Paper 1 | Advanced Accounts)

This book is prepared exclusively for the Intermediate Level of Chartered Accountancy Examination requirement. It comprehensively covers past exam questions with detailed answers, adhering strictly to the new scheme of ICAI.

The Present Publication is the 11th Edition for the CA Inter | New Syllabus | May/Sept. 2025 Exams. This book is authored by CA. Parveen Sharma & CA. Kapileshwar Bhalla, with the following noteworthy features:

- Strictly as per the New Syllabus of ICAI

- [Extensive Coverage] including:

- Past Exam Questions with Answers, including the January 2025 Exam (Solved)

- Questions from RTPs and MTPs of ICAI

- [Arrangement of Question] Questions in each chapter are arranged ‘sub-topic’ wise based on Para No. of each AS

- [Marks Distribution] is provided Chapter-wise from May 2024

- [Exam Trend Analysis] for the previous exams from May 2024

- [ICAI Study Material Comparison] is provided chapter-wise

CRACKER for Corporate & Other Laws (Paper 2 | Law)

This book is a comprehensive resource designed to help Chartered Accountancy students master the Corporate & Other Laws paper. This two-volume set covers the latest ICAI syllabus for the Intermediate Level (New Scheme). It features a vast repository of past examination questions (descriptive questions and case studies) and other practice material essential for a thorough understanding of corporate and other laws.

The Present Publication is the 5th Edition for the CA-Inter | New Syllabus | May/Sept. 2025 Exams. This book is authored by CA. Pankaj Garg, with the following noteworthy features:

- [Strictly Designed as per the New Syllabus] Adheres to the latest curriculum prescribed by ICAI for CA Intermediate (Group 1)

- [Topic-wise & Attempt-wise Segregation] Enables students to track and focus on frequently tested areas

- [650+ Descriptive Questions & Case Studies] Provides ample practice, ensuring a robust preparation for both theoretical and application-oriented questions

- [Coverage of Past Exams | RTPs & MTPs] Includes questions from previous ICAI examinations, Revision Test Papers, and Mock Test Papers up to January 2025

- [Comprehensive Two-volume Set] The combined set addresses both descriptive and objective learning needs, offering a holistic approach to Corporate & Other Laws

- [Author’s Expertise] CA. Pankaj Garg, a well-known faculty and multi-qualified professional, leverages his deep knowledge of law subjects and exam patterns

CRACKER for Taxation (Paper 3 | Tax)

This book is prepared exclusively for the Intermediate Level of Chartered Accountancy Examination requirement. It covers the past exam questions & detailed answers strictly as per the new scheme of ICAI.

This book is a valuable tool for students aiming to excel in their CA Intermediate examinations, providing comprehensive and up-to-date resources.

The Present Publication is the 10th Edition for the CA-Inter | New Syllabus | May/Sept. 2025 Exams. This book is authored by CA. (Dr) K.M. Bansal & Dr Sanjay Kumar Bansal, with the following noteworthy features:

- Strictly as per the New Syllabus of ICAI

- [Structured Sections] This book is divided into four sections:

- Income Tax Law

- GST

- MCQs & Integrated Case Studies | Income Tax

- MCQs & Integrated Case Studies | GST

- [Comprehensive Coverage] Coverage of this book includes:

- Past Exam Questions & Answers, including:

- CA Intermediate | January 2025 – Taxation

- Application Based MCQs

- Integrated Case Studies

- [Updated Solutions] are provided as per the Assessment Year 2025-26 and the Latest GST Law

- [Marks Distribution] is provided chapter-wise from Jan. 2021 onwards

- [Previous Exam Trend Analysis] from Nov. 2022 onwards

- [ICAI Study Material Comparison] is provided chapter-wise

| Weight | 2.890 kg |

|---|---|

| bookauthor | K.M Bansal, Kapileshwar Bhalla, Pankaj Garg, Parveen Sharma, Sanjay Kumar Bansal |

| binding | Paperback |

| edition | Edition 2025 |

| hsn | 49011010 |

| language | English |

| publisher | Taxmann |

Related products

Original price was: ₹2,835.₹2,120Current price is: ₹2,120.

Reviews

There are no reviews yet.