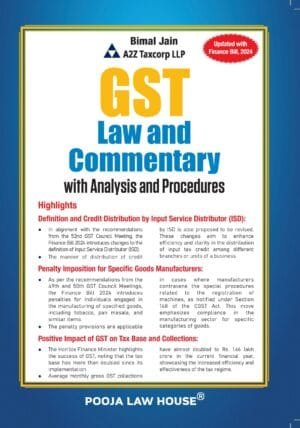

GST Law and Commentary Analysis and Procedures By Bimal Jain & A2Z Taxcorp LLP

GST Law and Commentary Analysis and Procedures By Bimal Jain & A2Z Taxcorp LLP

Description

About The Book

This GST book extensively covers in-depth analyses of CGST, SGST, IGST, UTGST and GST Compensation Cess Laws along with the Rules, Notifications, Circulars, Instructions and Clarifications issued thereunder and comprehensively discusses all the key GST provisions along with challenges and way forward suggestions, in commentary as well as tabular/pictorial formats with multiple practical case studies and examples. Further, this book provides a detailed insight to the readers for proper understanding of GST Law and rules made thereunder and useful to to professionals, corporates, regulators, govt. authorities, etc., for easy and convenient reference.

Highlights of Volume 1

- Detailed commentary on various domains of GST (law & provisions) viz. Supply of goods or services – intra-state and inter-state. Principles of time of supply & place of supply, taxable person, GST ITC, reverse charge mechanism, exports and imports, job work, TDS, TCS, etc., with practical case studies and illustrations & FAQs for conceptual clarity

- Discussion on all updated provisions and rules along with various notifications, circulars, clarifications, etc., as on date including all the decisions of the GST Council Meetings as on date

- Analytical discussion on all important GST pronouncements by Advance Rulings & High Courts and Supreme Court with settled legal jurisprudence of pre-GST era and their likely effect on businesses along with suggestion/ key precautions

- Effective takeaways and action plan for smooth sailing in GST with suggestions

Highlights of Volume 2

- Detailed discussion on constitution of the GST Appellate Tribunal and Benches thereof

- Detailed analysis on demand and recovery, inspection, search, seizure & arrest, etc., offences, penalties, prosecution, compounding, and appeals & revision, under GST with practical case studies and illustrations & FAQs for conceptual clarity.

- Detailed discussion with tabular presentation of all procedural requirements viz. registration, payment, invoice, refund under GST, e-way bill, along with relevant forms & their due dates, practical case studies, illustrations & FAQs for conceptual clarity

- Discussion and guidance for implementation of ‘e-invoicing’ and ‘QR code’

Highlights of Volume 3

- Detailed discussion with tabular presentation of all procedural requirements in GST Returns filing & matching of GST ITC – where GST credit is dependent upon tax compliant suppliers and Introduction of Credit rating system of taxpayers.

- Detailed discussion with tabular presentation of GSTR 9 and GSTR 9C

- Complete Guide and Manual for GST Rates of Goods or Services/ Exemptions of Goods or Services [updated as on date including all the latest notifications, circulars, press release, etc.]

- Multiple Case Studies and Legal Jurisprudence on Classification and Exemption of Goods or Services and its corresponding GST Rates and Exemptions

- Updated GST Rates Notifications for Goods or Services/ Exemption Notifications for Goods or Services [as on date]

Highlights of Volume 4

- Constitution (101st Amendment) Act, 2016

- Updated CGST, IGST, UTGST and Compensation Cess Acts, 2017 as amended vide the Finance Act, 2023 [Updated as on date]

- Updated CGST, IGST, UTGST and GST Compensation Cess Rules, 2017 [Updated as on date]

- Updated Gist of all Notifications – Tariff and Non-Tariff, Circulars, Orders, and Press Releases [Updated as on date]

- Index of all GST Forms along with their utility under GST

- Index of all GST Council Meetings

Scratch the coupon code given in the Book to download the following:

- All Updated Notifications – Tariff and Non-Tariff, Circulars, Orders, and Press Releases (Since July 01, 2017)

- All GST Forms along with their utility under GST [Updated as on date]

- Available functionalities on GST Common portal [Updated as on date]

- Updated Guidelines and Instructions by CBIC [Updated as on date]

- Updated GSTN Press Release [Updated as on date]

- All annexures that have been referred in all chapter(s)

- Revenue Performance Assessment of Indian GST

- Fixing the GST Process: Five Years of Iterative Problem Solving

- All India GST Audit Manual 2023

KEY FEATURES OF THE BOOK

- Detailed commentary on CGST, SGST, IGST, UTGST and GST Compensation Cess Laws along with the Rules made thereunder to encapsulate the provisions for easy digest

- Discussion on various domains – viz. supply of goods or services intra-state and inter-state, principles of place of supply & time of supply, taxable person, GST ITC, reverse charge, exports and imports, job work, GST rates, TDS, TCS, e-way bill, appeals and revision, demand and recovery, inspection, search & seizure, arrests, offences, penalties, etc.

- In-depth analyses of meaning and scope of term ‘supply’, principles of ‘time & place of supply’ with multiple case studies and likely issues with way forward suggestions Analyses and discussion on seam less flow of input tax credit in GST with multiple examples

- Case studies on various aspects of ‘valuation’ – transaction value, related party transactions, stock transfers, cross charge, etc.

- Analyses of Exports, Imports and supplies to or by SEZ units/developers in GST along with documentation required vis-a-vis refund mechanism

- Flowcharts on various rules & procedural aspects of GST-registration, payment, invoice, returns and refund along with guidance & implementation of ‘e-invoicing’ and ‘QR Code’

- Analyses of various provisions for assessment & audit, demand & recovery and offences & penalties, search, seizure, arrests and compounding of offences along with procedural flowcharts for appeals & revision and advance ruling

- Detailed discussion on constitution of the GST Appellate Tribunal and Benches thereof

- Discussions on filing of GSTR 1, GSTR 3B, GSTR 4, GSTR 6, GSTR 7, GSTR 8, GSTR 9/ 9C, GSTR 10 with payment of taxes

- All updated provisions and rules along with topic wise bifurcation of all departmental clarifications, CBIC FAQs as updated, press releases, circulars, orders, e-fliers, etc. as on date

About the Author

Bimal Jain

FCA, FCS, LLB, B.Com (Hons.) with 24 years of experience in Indirect Taxation – GST, Service tax, Excise, Customs, VAT/CST, Foreign Trade Policy, DGFT matters, etc.

Bimal Jain, qualified as a Chartered Accountant in May 1994, and Company Secretary in December 2006 and LLB in December, 2009. He has worked in renowned companies viz. LG Electronics India Pvt. Ltd, Honda Motorcycle & Scooters India Pvt. Ltd, Hindustan Development Corporation Ltd, Khaitan & Company. He is founder of of A2Z Taxcorp LLP, a boutique indirect tax firm since 2013.

Bimal is a Chairman of the Indirect Tax Committee of PHD Chamber of Commerce, Chairman of the Corporate Advisory Committee of IPEM Group of Institutions, Member of Indirect Tax Committee of FICCI & Assocham, Special Invitee of Indirect Tax Committee of ICAI, and Member of eminent faculties in Indirect tax committee of Confederation of Indian Industry ICAI/ ICSI/ ICMA/ CII/ PHD Chamber of Commerce.

He was awarded as the keynote speaker at Guinness World Record made by ICSI in “Largest Taxation Lesson” on GST, attended by 4500+ Participants, breaking earlier record of Japan. He was also awarded as Gold facilitator in 2022 by TIOL, Best Participant Award in MSOP – 117th Batch by ICSI, Business Leader Award by Amity School Noida, Best Speaker Award by NIRC – ICAI/ ICMA and Young Achievers Award at Igniting Minds, 2015.

He regularly writes articles on multiple GST and indirect tax issues and has authored books, namely, Service Tax Voluntary Compliance Encouragement Scheme, 2013 and various GST book titled ‘Goods and Services Tax – Introduction and Way Forward’, ‘GST Law & Analysis – With Conceptual Procedures’, ‘Guide to Revised Model GST Law (With Draft Rules on Registration, Payment, Invoice, Returns and Refund)’ and ‘The GST Reader (GST made easy)’.

He has also represented PHD Chamber of Commerce, Assocham, ICAI, ICSI before various Government Authorities/Committees viz. the GST Council, the Central Board of Indirect Taxes (CBIC), Ease of doing Business Committee, Empowered Committee of State Finance Ministers, etc.

Bimal’s core competency and area of expertise are indirect taxation, international and corporate taxation. He specializes in all aspects of GST, Excise, Service tax, Customs, Sales tax/VAT laws, Free trade/economic cooperation agreements, anti-dumping duty, foreign trade policy, etc.

He carries a blend of industrial and professional acumen, knowledge and experience in carrying out diagnostic review of business operations, opinion & advisory services, process review, structuring of various business models, litigation services at all appropriate forums including Commissioner (Appeals), CESTAT, High Court and representation made before the TRU/ CBIC/ DGFT, etc., for various matters concerning trade, industry and commerce.

| Weight | 7.65 kg |

|---|---|

| bookauthor | CA Bimal Jain |

| binding | Paperback |

| edition | Edition February 2024 |

| hsn | 49011010 |

| language | English |

| publisher | Pooja Law House |

Reviews

There are no reviews yet.