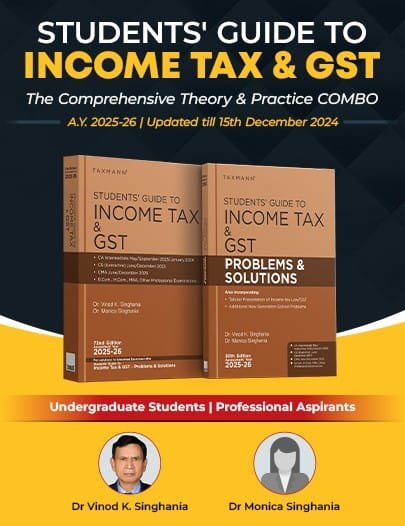

CA Inter Income Tax including GST Problems and Solutions

CA Inter Income Tax including GST Problems and Solutions

Description

The Combo offers a balanced blend of theoretical clarity and intensive practice. The first book lays down the conceptual groundwork of taxation (Income Tax & GST) in a simplified, step-by-step manner; the second complements this foundation by providing solutions to complex problem sets and unsolved exercises, reinforcing learning through practice. Each book adopts a student-centric methodology. With exam-oriented discussions, case studies, solved examples, and numerous practice questions, this Combo ensures you gain both conceptual clarity and practical problem-solving skills—vital for excelling in professional examinations.

The Combo is designed for a diverse audience, including undergraduate and postgraduate students (B.Com., BBA, M.Com.) seeking a comprehensive understanding of Income Tax and GST fundamentals with extensive examples to clarify complex provisions. It also caters to professional aspirants such as CA, CS, and CMA candidates. It provides tailored content that meets rigorous examination demands, featuring unique pointers, past exam questions, and in-depth problem-solving methods.

This Combo is authored by Dr Vinod K. Singhania and Dr Monica Singhania. It is updated till 15th December 2024 with the following noteworthy features:

- [Holistic Learning] Theory + Practice under one umbrella. The textbook provides core concepts, while the problems & solutions refine your problem-solving technique

- [Up-to-Date Amendments] Both books incorporate changes in Income Tax & GST legislation up to 15th December 2024, ensuring relevancy and completeness

- [Structured Presentation] Step-by-step exposition in numbered paragraphs fosters critical thinking, and point-wise chapter recaps reinforce memory retention

- [Practical Orientation] Case studies, illustrations, and solved examples reveal how theory is applied in practice, strengthening your professional competence

- [Confidence-building Exercises] Over 500 solved examples and an equal number of unsolved problems (with answers provided in problems & solutions) ensure ample practice and exam readiness

The individual book-wise features are as follows:

Students’ Guide to Income Tax & GST

- [Comprehensive Dual Coverage] Divided into two major units—Income-tax and GST—it covers everything from basic definitions to exempt incomes, deductions, computation of total income, supply under GST, composition schemes, and administrative procedures

- [Balanced Theoretical & Practical Insight] Each theoretical point is immediately reinforced by solved examples and followed by unsolved exercises, promoting hands-on learning

- [Teach Yourself Technique]

- Numbered paragraphs start with a concise analysis

- Incremental complexity in examples ensures you build problem-solving skills progressively

- [Exam-Focused Approach]

- Integrates past CA (Inter/IPCC) exam questions with fully worked-out solutions

- Unique markers (➠) for topics primarily targeting professional course requirements

- [Point-wise Recaps] Chapters close with key takeaways, aiding in quick revision and better concept retention

Students’ Guide to Income Tax & GST | Problems & Solutions

- [Dedicated Practice Companion] Addresses the unsolved exercises from the main guide through structured, step-by-step solutions

- [Three-tier Structure]

- Provisions in Brief – Quick refresher of key tax provisions

- Solved Problems – In-depth illustrations demonstrating problem-solving techniques

- Problems Similar to Unsolved Exercises – Model solutions reflecting the difficulty level and format of the main guide’s unsolved questions

- [Guided Methodology] Clear, annotation-based explanations guide you from the basic premise of a question to the final answer, making it easier to internalise the rationale behind each step

- [Realistic & Exam-Focused]

- Solutions mirror real exam settings, helping you understand how to tackle diverse question types

- Emphasises speed and accuracy, vital for professional exams

- [Seamless Alignment with the Textbook] Designed to cross-reference with the first book so students can switch back and forth for clarifications and deeper insight

About the author

Monica Singhania

Dr. Monica Singhania is an Associate Professor at, Faculty of Management Studies, University of Delhi. She is a post-graduate from the Delhi School of Economics and a Fellow Member of the Institute of Chartered Accountants of India. She has the distinction of being placed in the merit list of the examinations conducted by both the university and the Institute.

She has been awarded Ph.D. in the area of corporate taxation from the University of Delhi. She is the author of 7+ books on direct tax laws and several research papers published in leading journals.

Vinod K. Singhania

Dr. Vinod K. Singhania got his Ph.D. from the Delhi School of Economics in 1976. His field of special interest includes all facets of corporate legislation and corporate economics, especially tax laws.

Associated in different capacities with several professional institutes and business houses in India and abroad, Dr. Singhania has also authored many popular books and software published by Taxmann.

He has to his credit more than 300 research articles that have appeared in leading journals. He has been a resource person in over 800 seminars in India and abroad.

| Weight | 2.845 kg |

|---|---|

| bookauthor | Monica Singhania, Vinod K Singhania |

| binding | Paper back |

| edition | Edition 2025 |

| hsn | 49011010 |

| isbn | 9789393656001, 9789393656018 |

| language | English |

| publisher | Taxmann |

Related products

Original price was: ₹2,990.₹2,095Current price is: ₹2,095.

Reviews

There are no reviews yet.