CA Final Direct Tax Laws International Taxation Arvind Tuli May 24

CA Final Direct Tax Laws International Taxation Arvind Tuli May 24

MODULE 1

Chapter 1 (a): Structure of Law

(b): Basis of Charge

(c): Residential Status

(d): Rates of Tax

(e): Scope of Income

Chapter 2 TDS & TCS

Part a – Tax Deducted at Source [TDS]

Part b – Tax Collected at Source [TCS]

Chapter 3 Business & Profession [Sec 28 to 44]

Section A: Section 28: Receipts under Business or profession

Section B: Summary for Expenditure u/s 30 to 37

Section C: Summary for Restrictions on Allowable Expenditure

PART – C: Restrictions on Allowable Deductions

CHAPTER 3a Depreciation & Actual Cost [Sec 32 & 43]

CHAPTER 3b Income Disclosure Standards [ICDS] [Sec 145 & ICDS I to X]

CHAPTER 3c Presumptive Income [Sec 44AD/Sec 44AE/Sec 44ADA]

CHAPTER 3d Concept of Mutuality [Sec 28(iii) read with Sec 44A]

CHAPTER 3e Encouraging Non cash Transactions [Sec 269SS/ Sec 269T/Sec 269ST/Sec 269SU]

CHAPTER 3f Foreign exchange fluctuation [Sec 43A/Sec 43AA read with ICDS VI]

CHAPTER 3g Diversion & Application [A concept]

CHAPTER 3h Books & Audit [Sec 44AA & 44AB]

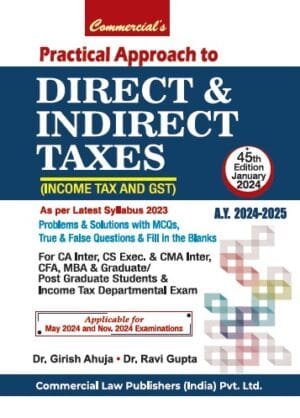

| Weight | 0.3 kg |

|---|---|

| bookauthor | CA. Arvind Tuli |

| binding | Paper back |

| edition | Edition 2024 |

| hsn | 49011010 |

| isbn | 9788196900090 |

| language | English |

| publisher | Bharat Law House |

Related products

Original price was: ₹750.₹600Current price is: ₹600.

Reviews

There are no reviews yet.