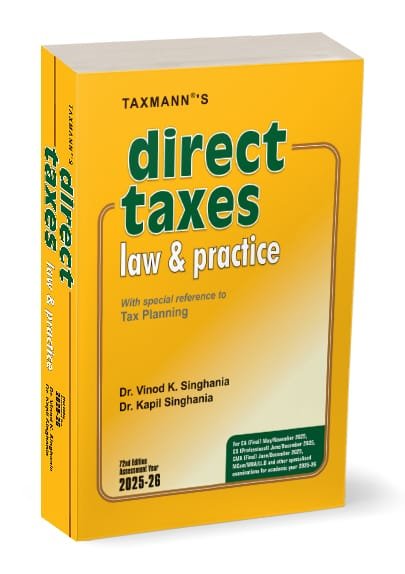

CA Final Direct Taxes Law By Vinod K Singhania May 2025 Exam

CA Final Direct Taxes Law By Vinod K Singhania May 2025 Exam

Description

Direct Taxes Law & Practice is a classic, authoritative guide to Indian direct tax law. It dissects and explains the complicated provisions of direct taxation with remarkable lucidity. Recognised and recommended by all major professional institutes and universities in India, it distils legislative amendments and judicial interpretations aligning perfectly with the Assessment Year 2025-26. The work stands out by merging theoretical discussions with ample practical illustrations—over 600 solved examples that help students, academicians, and practitioners grasp complex scenarios. Emphasis is also placed on judicial rulings, case laws, and official notifications, thus offering a highly reliable reference that keeps pace with evolving taxation norms.

This book is intended for the following audience:

- Students – Ideal for those preparing for CA, CS, ICWA, M.Com., LL.B., MBA, or other postgraduate and professional examinations. Serves as a comprehensive exam guide, presenting straightforward explanations of intricate laws and last 10 years’ CA (Final) questions with solutions

- Practitioners & Professionals – A must-have reference for chartered accountants, lawyers, tax consultants, and in-house finance teams looking for in-depth guidance on the latest amendments and leading case laws

- Educational Institutions & Libraries – Trusted by leading universities and professional institutes; a staple reference work in academic libraries for direct taxation

- Income-tax Department Officials – Useful for departmental exams, offering step-by-step insights into interpreting and applying direct tax provisions

The Present Publication is the 72nd Edition | A.Y. 2025-26 (amended up to 15th January 2025), authored by Dr Vinod K. Singhania & Dr Kapil Singhania. The noteworthy features of this book are as follows:

- [Latest Amendments & Judicial Rulings] Incorporates amendments, circulars, notifications, and judicial precedents up to 15th January 2025. Highlights crucial developments in case law that influence practical application

- [Lucid & Reader-friendly Presentation] Uses a numbered paragraph system for easy reference. Emphasises clarity, brevity, and an organised flow of topics, making a dense subject more approachable

- [Over 600 Solved Illustrations] Comprehensive examples address real-life scenarios and clarify subtle areas of tax law. Provides ‘hints’ for tax planning where applicable

- [Coverage of Past Examination Questions] Includes the last 10 years’ CA (Final) theoretical and practical questions with solutions adapted to the law for A.Y. 2025-26. It also features questions from other professional and postgraduate exams, ensuring thorough practice

- [Special Focus on Complex Issues] Discusses debatable or controversial points, arriving at logical conclusions grounded in statute and case law. Offers tax planning perspectives to guide strategic decisions.

- [Structured Thematically] Chapters are broken into sub-sections, each dealing with distinct aspects of direct tax law, ensuring easy topic-wise study

The structure of the book is as follows:

- Chapter-by-chapter Approach – Each chapter addresses one or more sections systematically, from simpler fundamentals to advanced concepts

- Paras & Sub-paras – Comprehensive yet time-saving layout that helps students identify crucial points quickly

- Illustrative Solved Examples – Over 600 illustrations are placed throughout the text, clarifying the application of complex provisions

- Practice & Revision Material – Exhaustive question bank, including CA (Final) past exam queries (practical and theory) updated for A.Y. 2025-26

- Case Laws & References – Integrated references to recent and landmark judgments, highlighting real-world judicial interpretations

- Tax Planning Notes – Strategic insights are interspersed within chapters, guiding readers on potential tax-saving measures

Vinod K. Singhania

| Weight | 2.01 kg |

|---|---|

| bookauthor | Kapil Singhania, Vinod K Singhania |

| binding | Paper back |

| edition | 72nd Edition 2025 |

| language | English |

| publisher | Taxmann |

| hsn | 49011010 |

Related products

Original price was: ₹2,395.₹1,915Current price is: ₹1,915.

Reviews

There are no reviews yet.